Hoops mismanaged company for personal benefit, lawyers say

Published 3:23 pm Tuesday, January 14, 2020

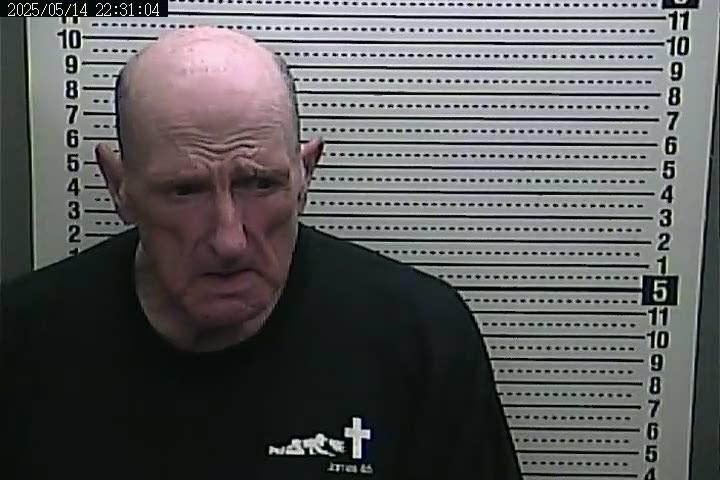

Hoops

|

Getting your Trinity Audio player ready...

|

Focus has slightly shifted toward Jeff Hoops, former CEO of the now bankrupt Blackjewel coal company, after attorneys representing the coal giant and its creditors asked for a judge to let them examine his finances. The attorneys said Hoops allegedly mismanaged the company for personal benefit, taking millions of dollars for personal and family gain.

Documents filed in U.S. Bankruptcy Court on Friday by lawyers for the West Virginia-based Blackjewel said the company “was woefully insolvent” by the time it filed for Chapter 11 bankruptcy protection on July 1, 2019.

Officials believe the push from the company is in response to Hoops seeking to recover at least $20 million from the bankrupt coal producer.

Lawyers claimed in the 48-page motion the bankruptcy may not have been necessary without the alleged mismanagement by Hoops.

“This level of insolvency and inevitable bankruptcy filings were the result of a years-long effort by Mr. Hoops to transfer tens of millions of dollars of (Blackjewel’s) assets for his benefit and the benefit of his family and other Hoops-related entities,” the motion reads.

Hoops, his family and other businesses tied to his name claim they are owed at least $20 million from loans made to the company prior to filing for Chapter 11 bankruptcy, leading the company to ask a federal bankruptcy judge to get Hoops, his family and other affiliates to testify.

Lawyers also want Hoops to produce documentation to prove his claims about what he is owed, including being asked to verify his accounts and to explain why he loaned money to keep Blackjewel from going bankrupt.

Another allegation listed in the motion is that Hoops and one of his companies, Clearwater Investment Holdings, “received more than $41 million” in distributions from Blackjewel prior to the bankruptcy filing “just in 2019 alone.”

If the allegation is true, the money wouldn’t have been subject to any properly executed loan agreements “or other writings or specific terms establishing these distributions as loan repayments,” according to the court filing.

“These ’ arrangements’ were never approved by (Blackjewel’s) board of directions nor were they subject to any other independent, third-party review.”

At this time, Hoops has denied to comment due to advice given by his lawyer on the allegations made in the motion and he has continued to recite the statement he first released in mid-2019, which states he “has done nothing wrong” in regards to how the company and it’s employees were managed.

“The relevance to our shafted miners is that if those in control of Blackjewel retrieve any assets from Hoops, that money goes back into the hands of those in control of the company, and increases the chances of money being returned to the miners,” said Ned Pillersdorf, a lawyer representing Blackjewel miners throughout the region. “The interesting part of the pleading filed by Blackjewel is that it makes similar diversion allegations that we alleged against Hoops is the adversary pleading we filed last year on behalf of our shafted miners.”

There has been another mediation scheduled for Feb. 5 in the federal bankruptcy court in Charleston, West Virginia.